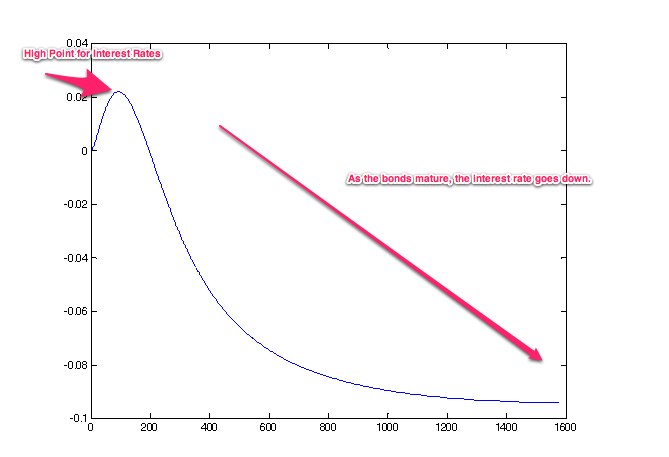

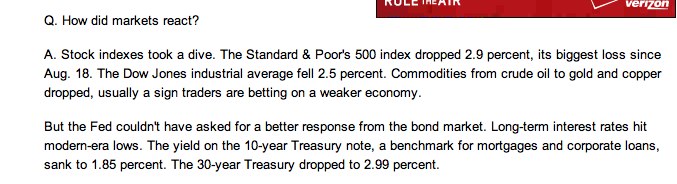

The results are in: August of 2011 saw zero job growth. Amidst a summer of political squabbles over the debt-ceiling and the looming European debt crisis, the U.S. experienced its first month since October of 2010 that had absolutely no increase in jobs. And zero is a scary figure, especially for those who are one of 14 million unemployed Americans in the process of looking for a job.

But those Americans who are job hunting should not be scared of facts and figures. A task that is daunting even in the best of times can be easily tackled with a little bit of forward thinking. There are five simple ways in which you can land a good job in even the worst of economies.

1. Update Your Resume to Make it Recession Specific

When job hunting these days, it is the potentional employees job to sell themselves to companies; you need to convince them why you are worth the money of hiring. A resume is a great way to first show employers how you would be an asset in tough financial times.

The best way to do that is to demonstrate to companies that you can turn a profit for them, and bring in new clients. Jan Corn has helpful tips on writing resumes that show employers that you make them money. She also advises using specific examples instead of vague terms.

Joe Turner on Monster.com provides some of those specifics. He insists that your resume should focus on how you can help the company you are applying to specifically, such as proving how you can stretch a budget or show accomplishments that demonstrate you can thrive in challenging times.

Once your resume is recession ready, the next step is to network.

2. Be Creative in Your Networking

The job hunting methods of yesteryear are no longer effective in a bad job market. Therefore the unemployed need to inject a bit of creatively in how and where they look for jobs. The unemployed must go beyond the usual job fairs, employment sites, and buzz word searches.

A great way to do this is network in places you wouldn’t expect to. Fiona Robyn, in an article for Do Your Own PR, suggests reaching out to loosely associated events in your field, old colleagues, and even the man sitting next to you at the cafe in the morning. You never know who can help you out, so it helps to be a generally nice person.

And with the changing landscape of social interaction, social media can be a great way to connect with more people than you ever could before. Mashable.com offers several great tips on how to improve networking on social media sites.

3. Don’t Appear Desperate for Work

When applying for a job, confidence is key. But when someone is desperate for work, it’s very difficult to appear assured. Remember, you are marketing yourself as someone they would be lucky to hire. So how does one keep from seeming too eager?

The solution is an easy one: have enough money while job hunting to not actually be desperate. That way, there is no fakery involved. There are many ways to make money while unemployed, such as spending less money, filing for unemployment, and working odd jobs.

But job hunting does take time, and can feel like a job in and of itself. The Coupon Sherpa has compiled a list of 24 ways you can make money quickly while unemployed. The suggestions range from house sitting to handyman to freelance and consulting work.

The last one, specifically, has the prospect of becoming more than a side job.

4. Make Your Part-time Your Full-time

Perhaps you have a specialized skill set, and end up enjoying the freelance and consulting work you do to pay the bills while looking for employment. You can make the choice to do freelance or consulting work as your profession.

And you would not be alone: About.com has a whole section of its website devoted purely to freelancing and consulting. The articles in the database offer tips, and the whole site provides a community and resources.

Getting started in freelance and consulting work, however, is difficult. Escape from Corporate America, the website of career coach Pamela Skillings, has a useful guide on how to begin working in freelance and consulting. The guide insists that consulting work is useful even in the short term for it will help you network and gather clients, therefore making you more hirable to someone else.

5. If All Else Fails, Move to an Industry that Actually Has Jobs

Not every sector is growing or hiring, and perhaps your chosen field is one of them. This is where you need flexibility, because there are a few industries that have continued to grow and hire despite the poor economy.

The Atlantic lists 12 such industries that actually grew in 2010, including high tech equipment manufacturing and health care. Health care alone gained over 160,000 jobs last year.

Besides bed rock industries such as health care that will always be needed, there are also some industries that actually do better during a recession. The unemployed can be entrepreneurial and take advantage of the poor economy with jobs in debt collection, online auctions, and career consulting.

Anyone can get a great job if they just think a little creatively. Confidence, flexibility, and critical thinking are all one needs to find the employment they deserve.