The Atlas dome watch is elegant and timeless, like all of Tiffany & Co.’s

jewelry. Its thick band is made of gleaming stainless steel and 18-karat gold. It’s

Swiss-made and water resistant. Despite this $6,200 watch’s level of quality and

design, Tiffany and Co.’s watches only represent 2 percent of their total sales.

If Tiffany has a well-oiled marketing campaign to sell its watches, it isn’t

showing. Demand for watches has remained below 2 percent since 2007, when the company partnered with the Swiss watch manufacturer, Swatch Group, in an effort to further expand the company’s luxury brand and grow less than robust net sales.

“Entitlement to business, even in the luxury market, is history. You have to

get the proper messaging to sell to your client,” said Christopher Ramey, founder of Affluent Insights, a consulting service whose clients include the Four Seasons Hotel in Miami, Bentley and Neiman Marcus.

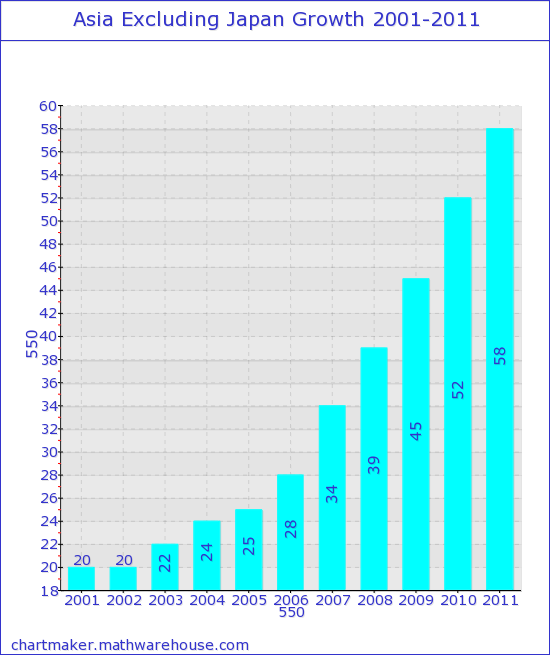

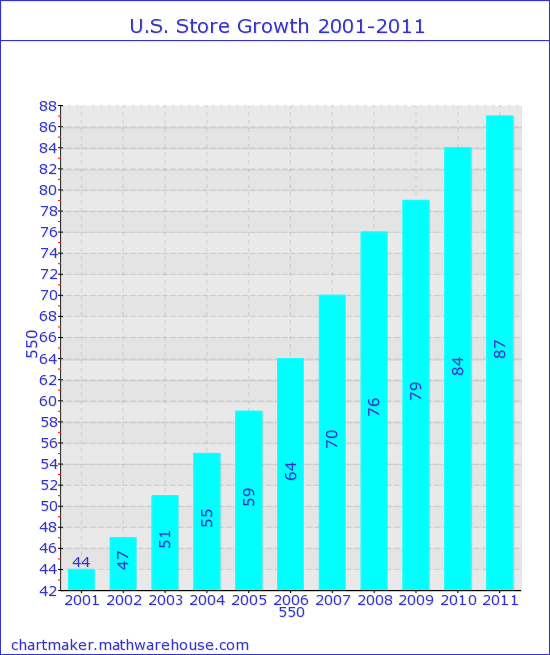

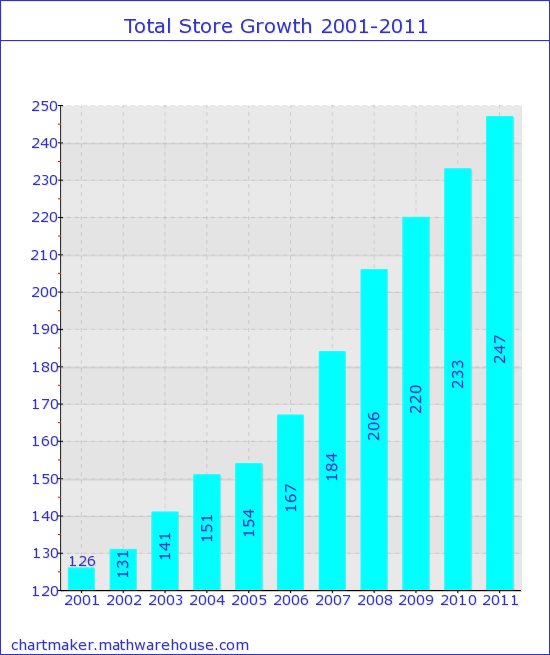

For over 10 years, Tiffany planned to boost its net sales by expanding stores in the United States and overseas. From 2001 to 2011, Tiffany grew all of its stores from 126 to 247 stores. During the same period, Tiffany grew its Asia stores, excluding Japan, from 20 to 58 and its European stores tripled. Tiffany could not foresee the 2008 financial meltdown, however, or the international economic pain it would cause. A slowdown in China, tsunami in Japan and European debt crisis are threatening an international reach that was previously an advantage for the company.

A JP Morgan Chase & Co. analyst report, “Specialty retail: Taking a luxury mulligan,” speculated that international economic weakness, especially Asia excluding Japan, indicate Tiffany will face further stress down the road, leading to a downgrade of “neutral.” “While comps within the segment continue to outpace the total company, the rate of change has clearly decelerated meaningfully over the past 12 months,” the report read. “A broad based geographical slowdown should lead to a downwardly revised outlook which makes the stock difficult to predict in the near-term.”

International weakness coupled with a changing jewelry industry highlights the storied company’s main problem. Tiffany is not fighting for a long-term place in the jewelry market or continuing to grow at the pace that analysts would prefer. Net earnings increased 39 percent in 2010 in comparison to 2009 but only grew 19 percent in 2010. Net earnings declined 30 percent in this third quarter compared to third quarter last year.

Though Tiffany is far from being labeled as a failing company, it is not expanding or innovating as other jewelry companies and luxury brand names have done. The jeweler needs to make sure it remains relevant in an industry where unusual fashions are becoming more popular and specialty jewelers like Tiffany find themselves in the minority. Tiffany is trying to compete against a mix of big department stores, such as Macy’s, and higher-end brands such as Cartier, which are owned by larger companies and better at marketing a vaster expanse of products.

Tiffany’s latest earnings report did not restore investor confidence, either. The company lowered its outlook for earnings expectations for the third time in a row. Shares fell 6 percent the day the company released its third quarter report. Third quarter revenues were up 3 percent and comparable store sales rose only 1 percent compared to the third quarter last year. Gross margins fell 54 percent. Tiffany adjusted its previous guidance of $3.55 to $3.70 earnings per share to $3.20 to $3.40 earnings per share.

A dimmer view of Tiffany, compared to the image of a brand that initially bounced back quickly from the financial crisis, is propelling the company to continue pursuing expansion into other territory, such as watches. Men’s demand for watches grew from 2008 to 2010, which accounted for two thirds of growth in jewelry sales in those years, according to a Unity Marketing report. A report by Koncept Analytics, a global marketing research firm, also highlighted the importance of the growing watch segment. Watch sales increased 10.6 percent in February 2012, and was cited among the fastest growing jewelry categories, with bridal merchandise and fashion jewelry. Unlike engagement andother diamond jewelry categories, which have lost market share from 8 to 7 percent and 41.8 to 35.7 percent, watches held their market share of 13.27 percent from 2008 to 2010.

Tiffany has many marketing tools in its arsenal, whether it be predictive modeling or a strong brand, but its marketing quality is inferior to Cartier and Louis Vuitton’s, Christopher Ramey of Affluent Insights explained. Lack of marketing prowess, however, shouldn’t be a barrier to Tiffany if it continues to compete with smaller jewelers, Ramey said.

“Cartier is an iconic brand and they do a really good job, yes, a superior

job, but they won’t be in the primary camp Tiffany is in,” Ramey said. “Tiffany will

take it away from individual jewelers who depend on obscure brands. Tiffany

takes it away from them because they’re undercapitalized, even though they

position themselves as a peer to Cartier and other high-end luxury brands.”

Taking market share away from individual jewelers may work well for

Tiffany, as Tiffany is fighting for market share with Wal-Mart, Costco. J.C.

Penney and other low-end multi-retailers. Those large department stores’ jewelry

sales rose 15 percent in December of 2011, the month in which jewelers make

their best sales, according to a Koncept Analytics report. Unlike those mega-brands, small chains and independent jewelers account for 70 percent of the U.S. Jewelry market. Smaller jewelers also allow for easier competition.

If Tiffany wants to continue to compete with major retailers and larger luxury brands, however, the company will have to expand into other products and build a stronger collection of watches, purses, and perhaps more fashion accessories. Regardless of which jewelers Tiffany competes with, Ramey sees CEO Michael Kowalski’s goal to expand watch sales from 2 percent to 8 percent of total jewelry sales within the next year as a bit unrealistic.

“Tiffany will be able to grow its share but 8 percent is a really aggressive

point of view. Out of total sales, 2 to 8 percent is a heavy achievement if you can

do it,” Ramey said.

As men’s demand for watches continues to grow, jewelers that used to

focus almost entirely on engagement rings and other women’s jewelry are

adapting to include more choices for men. Signet Jewelers, owner of Kay Jewelers and Jared’s, released a 2012 annual report that showed watches accounted for 31 percent of the jeweler’s sales. Compagnie Financiere Richemont SA, which owns Cartier, Van Cleef & Arpels and Piaget, among others, reported watches as 26 percent of their sales in their 2012 annual report.

Those companies stock prices have also risen in the past five years. Signet Jewelers’ stock price started at $26.10 five years ago. It is now $53.86 as of December 7. Compagnie Financiere Richemont SA’s stock price rose from $18.35 to $76.76 as of December 7. Tiffany’s price has grown from $42.92 to $58.40 as of December 7.

Tiffany has been behind the trend and attempted to catch up by

partnering with Swatch Group in 2007. After Swatch Group and Tiffany engaged

in a lawsuit, that planned 20-year partnership is gone. Post-arbitration, Tiffany

plans to rebuild its watch strategy and grow that part of the business to 8 or 9

percent of its sales in the next year, CEO Michael Kowalski said in a conference,

as high as watch sales were in the 1980s. It is unclear, however, if Tiffany can hit

that target, without any inkling of a new partnership with another watch

manufacturer or the kind of global marketing strategy it employs to sell

engagement rings. Tiffany & Co. spokesman Mark Aaron did not return phone calls or emails by the time of publication.

Tiffany has been behind the curve because the company changed their strategy in the late 1980s and began to focus almost exclusively on the engagement ring business. When the company was owned by Avon from 1979 to 1984, it was downgraded to the lower-end of the spending spectrum and lost its cachet with customers looking for high quality diamond jewelry. The company decided to revamp its image, focusing on the engagement ring business at the detriment of watches and other accessories. As William R. Chaney’s group bought Tiffany in 1984 and later took the company public in 1987, the company restructured itself. Watches were no longer manufactured by two historic Swiss brands, Patek Philippe and Audemars Piguet, as Tiffany decided to manufacture watches itself.

The company has been refocusing on watches for the past five years. In

2008, Harkness Consulting wrote a report, advising Tiffany & Co. to plan on how

to grow watch sales, because men are brand focused and willing to lay spend a

considerable amount of money on the “ultimate status symbol.” The consulting

group also suggested Tiffany consider opening men’s only stores to woo

Japanese customers.

“In general men are more brand-focused than their female counterparts,

and Tiffany and Co. should play its strong brand to its advantage in this market.

Japanese men in particular are extremely brand-focused,” the report read.

“These stores will help portray Tiffany not just as an engagement ring store, but

as a luxury destination for men, potentially opening up a new market within

Japan.”

Harkness Consulting also noted that Tiffany was not competing for

timepiece sales on the same level as other brands in the luxury jewelry industry.

“Within the luxury jewelry industry, competition in watches is fierce.

Currently, Tiffany does not have a substantial presence in the highly profitable

watch industry.”

.

Today, most of Tiffany’s ads feature its iconic blue box or photos of regal

women wearing evening gowns on rain-drizzled cobblestone streets. Through the

1960s to the 1980s, Tiffany marketed men’s watches with the same dedication

as their engagement rings. In 1976, Tiffany presented the watch as the embodiment of influence and heritage in a creative ad that featured the Capitol building. Mimicking the shape of the building, a watch lay horizontally across the horizon of the photograph. The caption read, “1851: The cornerstone of the United States Capitol was laid and Tiffany introduced Pateke Phillippe to America.” If company executives want to stake their claim on luxury watches, and continue to remain relevant in a transformed jewelry industry, Tiffany will have to harken back to those days and market watches as the ultimate status symbol they are.

View U.S. Tiffany Stores in a larger map