The economy of Flushing, Queens, appears to be growing. Employment has risen 3.1

percent from 2010 to 2011 in comparison to the rest of Queens, which experienced

only incremental growth and Manhattan employment grew by 0.7 percent,

according to an Office of the New York State Comptroller report released in

September. Flushing residents’ total wages grew by 16.9 percent from 2008 to 2010.

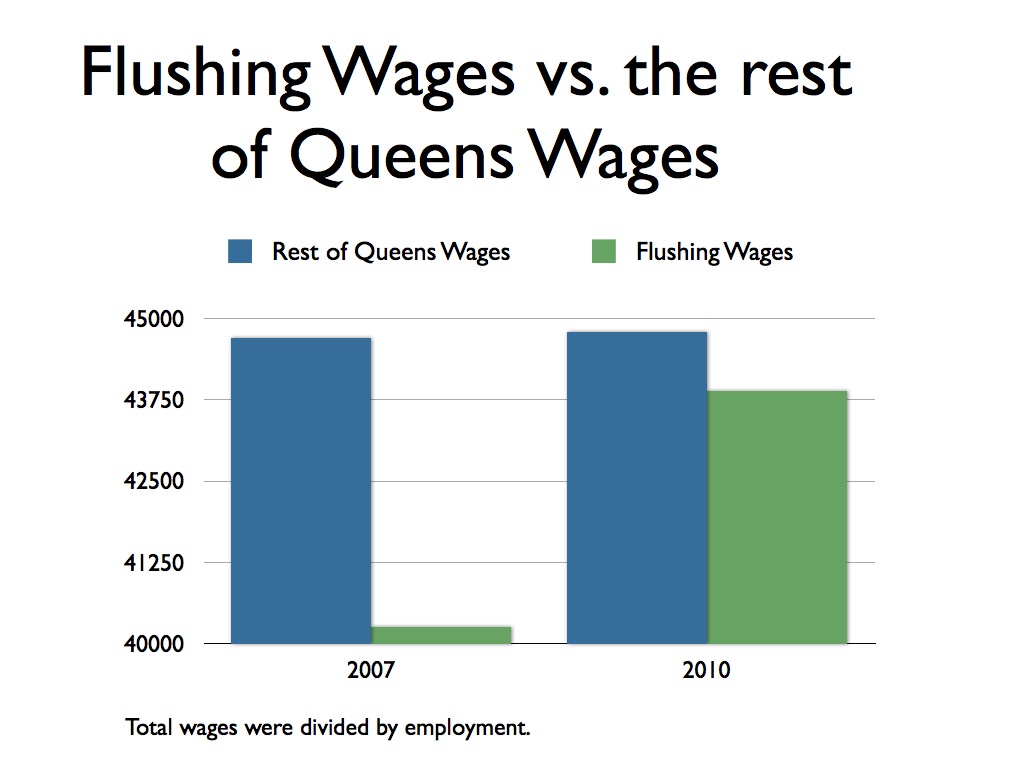

Though wages have risen, the average Flushing salary started at $40, 251 in 2007

while the average Queens resident brought home nearly $4,500 more during the

same year. Flushing residents still made $912 less than the average Queens resident

in 2010.

Flushing’s economy is influenced by many small, often family-run businesses.

Restaurants, clothing stores and beauty salons line Roosevelt Avenue, Main Street

and 34th to 35th Avenues.

According to the U.S. Census Bureau, which was cited in the comptroller’s report on the effect of immigration on the economic vitality of New York City,nearly 90 percent of the Flushing’s businesses had fewer than 10 employees.

Lisa Ling, 23, helps her husband Eric Ling, run their small business, PICCHIO, a clothing and accessories store at New World Mall in Flushing. Ling said they are struggling to make ends meet. When the couple first opened the store there was an influx of shoppers but now they don’t have enough money to buy Christmas presents for their children or visit family in China.

Eric Ling, 24, co-owner of PICCHIO, said he was surprised by the 3.1 percent

increase in employment reported by the comptroller’s office. He said many Flushing

residents create small businesses but they do not stay in business for very long.

They change the owner at these (Chinese) restaurants every couple of months,”

Ling remarked. “A lot of them don’t know how to run a business. Price is too high

or quality of service isn’t good.”

The American Community Survey, which averages demographic results gathered

from 2005 to 2009, estimated that 63, 778 Flushing residents are not U.S. citizens.

When compared to ACS estimates of the entire Flushing population, it would total

25 percent of Flushing residents.

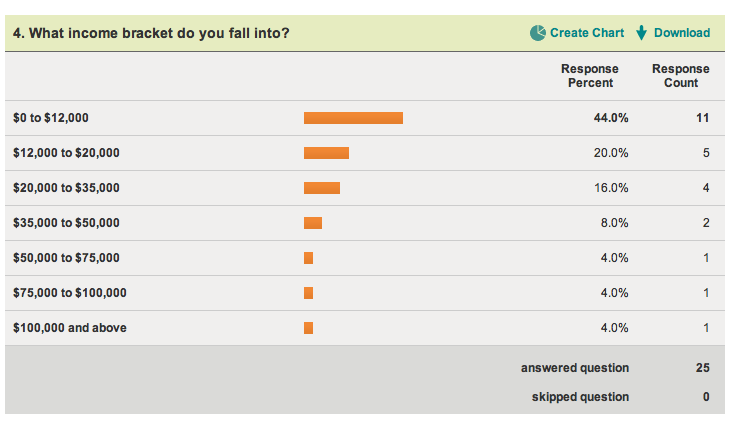

Without an accurate number of how many businesses are operating or any device to

track the success of businesses once they are created, there is not a clear picture of

how well sustained economic growth is, or whether it has created a stable quality of

life for residents.